Texas Reinstatement Guide

Hire Kuma Filings!

Kuma Filings is prepared to assist with any reinstatement situation that your business might be facing.

If at any point in this guide you feel as if you would like to have someone else take a look into your situation for you and assess the reason for forfeiture, the steps you need to take or to give you an estimate of cost to hire Kuma Filings, reach out at any time and someone will be in touch within 24 hours.

This is a completely free consultation with an expert in the field of Texas business Reinstatements.

Step One: Don’t panic! There is a solution.

Even though panic isn’t necessary, reinstating a business in Texas can be a messy task. There are a few reasons why a company might be forfeited and each reason has it’s own method of getting the business back into good standing. Kuma Filings will break down the reinstatement process for each scenario in this easy to understand guide. Check out the links below to skip to the section relevant to your specific needs. When in doubt, an expert can take a personal look into your situation by contacting Kuma Filings.

- Hire Kuma Filings!

- How do I find out why my company was forfeited in the first place?

- Reasons for Forfeiture Explained

- Resolving Tax Forfeiture

- Filing Your Reinstatement with the State Online

- Resolving Involuntary Termination

- Resolving Registered Agent Resignation

- Resolving Voluntary Dissolution / Withdraw

- What to do if your business name has been taken while your business wasn't active on the state record

- Reinstating a Non-Profit Organization

- Reinstating a Professional Association

- Hire Kuma Filings!

How do I find out why my company was forfeited in the first place?

The first step to finding out why your business was forfeited is to search up your business on the state record and see what it says.

Take a look at these steps to walk you through that process.

- Head over to the Texas Secretary of State website.

- If you already have an account, log in using your credentials. If you don’t have one already you can either create an account or use a temporary account by selecting one of the options under the login button

- On the next page, choose the Credit Card option and enter in your card details in order to proceed since each search costs $1.

- With that out of the way you’ll need to click on the Business Organizations tab along the top bar

- A new page will give you lots of links to choose from. Find the one called Find – Entity and click on that

- Enter in your business name and search for it

- If nothing comes up, go back and double check that everything was entered correctly. If it was, give the Secretary of State a call at 512-463-5555 to find out why your business isn’t coming up

- If you see your business listed and the status is Active or In Use, your business is not yet forfeited. The Texas Comptroller of Public Accounts may be in the process of forfeiting it, meaning you have a window of time to remedy this before the forfeiture fully goes through. Give the Texas Comptroller a call at 512-463-4600 or 800-252-1381 so you can see what they need to keep your business in good standing or reach out to Kuma Filings for quick assistance!

- If you see your business listed and the status is Forfeited, Involuntarily Withdrawn or any other iteration of these, go ahead and click on the 9 digit Filing Number next to your business name to pull up your company details

- You’ll be directed to a page that shows your business information, including the company name, type, start date and status. Highlighted yellow will be your Registered Agent tab, but what you’ll need to look at is the Filing History tab right next to it.

- Anything that has been filed for the business with the Secretary of State is stored here, accessible by the pen and paper icon to the left of every filing. Somewhere around the bottom of this list of filings will be the forfeiture you’re looking for. It may be called Tax Forfeiture, Involuntary Dissolution, Voluntary Dissolution or some other similar type.

- Once you’ve found it, click on the pen and paper icon for a description by the state as to why this has occurred for your business. For a deeper explanation, check out the common reasons further along in this guide to understand more

Reasons for Forfeiture Explained

Forfeitures can happen for a variety of reasons. Let’s look into some of the more common ones.

Tax Forfeiture

This is the number one most common reason for a business to be forfeited with the Texas Secretary of State.

To put it plainly: the taxes were not filed. Sometimes a business owner might not file because they didn’t make any money and thought they wouldn’t need to, hired someone who didn’t fulfill their role or simply forgot. There are plenty of reasons why a report or two got missed over the years and forfeitures commonly happen because of it.

All businesses, unless certified by the Texas Comptroller of Public Accounts as tax exempt, must file their annual report every year by May 15th. If the 15th falls on a weekend, it’s due by the next Monday. If this is missed the Texas Comptroller will mail out a warning to let the business owner know the business will be forfeited if the report isn’t filed. Usually they allow it to get to two reports overdue before they move forward with that process, so if your business is Tax Forfeited, expect to owe two or more reports as a likely cause. Once the Texas Comptroller decides to forfeit the business, you will have 120 days to file those missing reports to get back in good status with them. If you don’t do this within this window, the Texas Comptroller will let the Secretary of State know that your business needs to be placed into Tax Forfeiture status, thereby making your business delinquent.

Involuntary Termination

Often this is due to the Registered Agent having resigned (see more on this reason below).

However, this generalized terminology encompasses a few other scenarios too. The state uses this type of forfeiture title to blanket any Secretary of State related issues. If the Registered Agent hasn’t resigned, this may be due to not paying filing fees. For example, a company may have mailed in the paperwork to form on the state record. The state will temporarily list the business while they await the filing payment, however if the payment is not received within a certain time frame they will forfeit the business.

If the information available on the state doesn’t make sense you can reach out to the state at 512-463-5555 or have Kuma Filings assess your situation for free.

Registered Agent Resigned

Occasionally a Registered Agent will resign. There are plenty of reasons an agent might do this such as; too many missing payments, if they went out of business and closed down operation completely or maybe a business partner who was listed backs out. Whatever the case, the Registered Agent files a form to resign from your business information, leaving you without an agent.

The Secretary of State requires the business owner to have an agent appointed at all times, although they do give a grace period for you to select and list a new one. If no new agent is listed within that time frame the Secretary of State will involuntarily forfeit the business.

Voluntary Dissolution / Withdraw

In other cases the company has been shut down against the business owner’s will for one reason or another. In the case of voluntary dissolution, the business has actually been terminated by choice. Voluntary dissolution/withdraw means that the business owner or someone acting on the business owner’s behalf filed dissolution paperwork to end the operation of the business in Texas.

Even though this was done on purpose and someone intended to cease business operations, this can be undone by following the steps further down in this guide.

Resolving Tax Forfeiture

Attention Non-Profit Organizations: You will not need a Certificate of Account Status to reinstate. Skip down to the bottom of this guide; Reinstating a Non-Profit Organization.

Obtain your webfile number

The first step to getting your business reinstated is to obtain your webfile number. If you already have it, that’s lucky! Skip down to the next section, if so.

For the rest of you, worry not. We’ll go over how to retrieve this number from the state so that you can move ahead with your goals.

What even is a webfile number?

When your business is first registered with the Secretary of State, they send that shiny, new formation information over to the Texas Comptroller of Public Accounts. The Texas Comptroller uses that information to establish your business in their database as a company that will need to file taxes every year by May 15th. Upon doing so, a taxpayer number and a webfile number are generated, unique to your business. The taxpayer number rarely changes, although in some instances it may, and can always be found by searching your company name on the free business entity search.

The webfile number, on the other hand, is mailed out to the mailing address given on the filing. This usually mails out to the business within two to four weeks following the formation date. The webfile number you will first receive is a number starting with FQ with six digits behind it. For example; FQ555333.

Every year around February the Texas Comptroller mails out the reminder for the business owner to file their taxes by that coming May. In this notice, an updated webfile is presented starting with XT. For example; XT444222. The FQ number often still works even though the new XT number has replaced it, so it’s worth a try to use it if that’s all you have.

Please note, if you have an RT number, like RT888666, this is used for the Sales & Use Tax and would not be useful when reinstating. Either the FQ or XT number will be needed.

- Look through your records.

Since the webfile number is mailed out when your business is formed and annually every year thereafter, you might have stored that away somewhere with other long lost important documents. This might be in a physical or digital file.

Unfortunately in many cases business owners toss the notice and inadvertently lose their webfile number. It happens all the time! - Check your previous Registered Agent or mailing address.

If your business has gone through mailing address updates due to changing your Registered Agent, moving offices, etc, then you may be able to back track. A previous Registered Agent might still have the document on file, or if you still keep in touch with a previous address you might be able to obtain it from whoever is occupying that home or business now.

Even if you aren’t able to locate it, perhaps now is a good time to make sure your mailing address is up to date. You can see what’s listed by using the free business entity search, then update it if needed through the online resource here. If waiting on hold is more your style, the Texas Comptroller can do it for you over the phone at 512-463-4600 or 800-252-1381. - Request a new one from the Texas Comptroller of Public Accounts.

When all else fails, getting a new webfile number might be your only option. In most cases this is not difficult to do and may simply require some patience since the hold times when calling the Texas Comptroller can vary. For the best results call earlier in the day. If you’re calling during the non-tax season (June – December), you’ll have less wait time than calling during the busy season (Jan – May).

To begin, prepare yourself for a bit of a wait time and give the Texas Comptroller a call at 512-463-4600 or 800-252-1381. Once you find yourself speaking to a fellow human being it can go one of two ways.

1. You will be able to verify the information they ask for and they’ll provide your webfile number to you over the phone. The information they ask for is usually in regards to previous revenue amounts that you’ve filed in the past. If you have never filed a report or don’t know your amounts from the past you might be out of luck with this outcome. If you are able to pass their quiz and obtain your webfile number, proceed onward with the reinstatement process further in the guide!

2. If you aren’t able to verify the information they want, they’ll need to send out the webfile number to you the old fashioned way: snail mail. If you haven’t already, be sure they have the correct mailing address for your business and update it with the person on the phone if they don’t. After that… more waiting! The webfile number should take one or two weeks to arrive to the mailing address the Texas Comptroller has on file.

Tip: Ask the agent on the line from the Texas Comptroller how many reports are due to get your business back in good standing so that you don’t have to research this on your own later or, even worse, call them back again.

General information about Annual Reports and cost

The Annual Report in Texas has changed as of 2024. In 2023 and prior the Annual Report was actually comprised of two different reports: The Franchise Tax Report and The Public Information Report. Having both of these filed kept your business in good standing with the Texas Comptroller. In 2024 and beyond it’s now structured so that you will only file the Public Information Report by itself. These rules only apply for those reporting under the threshold – more on that below.

The number of reports that are due will determine what the cost will be to reinstate.

With the exception of the 2024 report, all Annual Reports in Texas have a $50 late penalty imposed upon them. This means that if you owe the 2022, 2023 and 2024 Annual Reports, you would end up paying the Texas Comptroller $100 for the late penalties. In most cases a business is only behind 1 – 3 reports, and although it’s not impossible to be much further behind on report filings, it’s fairly rare.

If you are reporting over what is known as the No Tax Due threshold then you will owe a percentage of taxes based on the amount you’re filing. If you are under it, your tax responsibility would be $0. These thresholds are as follows:

For 2024, the threshold was $2.47 Million

For 2023, the threshold was $1.23 Million

For 2022, the threshold was $1.23 Million

For 2021, the threshold was $1.18 Million

For 2020, the threshold was $1.18 Million

If you are under this threshold you will be filing a No Tax Due report, which means you will owe no taxes. If you’re above it, you’ll need to file an EZ Computation Report (for revenue above the threshold all the way up to $20 Million) or the Long Form Report (for revenue over $20 Million) for any year you are over regardless of what year it is being filed for.

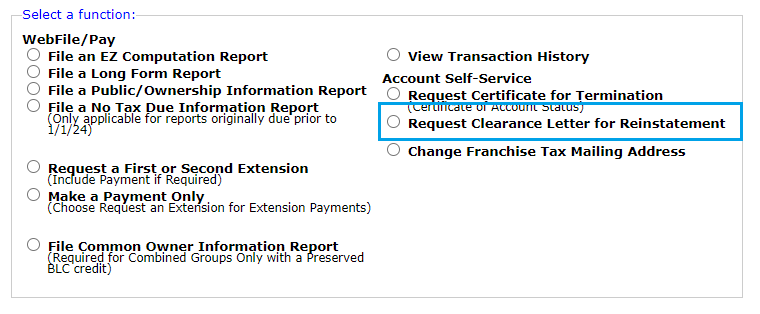

Tip: Once you are logged in, click on Request Clearance Letter for Reinstatement.

When you first access your business information in the Texas Comptroller portal you can come directly to this button and follow the few prompts to obtain your Certificate of Account Status for Reinstatement, also known as the Tax Clearance letter. At the end it will either show you a green bar and allow you to download the certificate or it’ll give you a list of reasons why it can’t provide it. This is a perfect way for you to find out exactly what reports or payments are needed in order to get caught up with the tax responsibilities.

As you go through this process you can come back here to see if your Annual Reports and payments have been accepted yet, since those can take a couple of days to process once you’ve submitted them.

File Online – 1 or 2 Reports Due

Now that you have an idea about how the reports work you’ll need to actually get down to filing them.

To begin, follow these steps:

- Access the Webfile Portal here

- Either login to your account or create a new one to proceed

- Once you’re logged in you should see a blue button to the right hand side of the page that says “+ Assign Taxes/Fees“. Select it

- Enter in your 11-digit Taxpayer Number which can always be found for free here by searching your company name

- A white tab called Franchise Tax will drop down and allow you to put in the webfile number. Put in the full FQ or XT number. If this is green when you come to this page, this step has already been done. Go back to the first login page and jump to step 8

- Check the box and agree

- You will be routed back to the main page, though this time you should see your company as an available selection

- Click on your company in the box to open up your specific details

- About 10 or 11 bulleted options will show up on this new screen and this is where things can get tricky based on individual differences between companies

Let’s go through the important ones to know about so that you can make an informed decision.

+ File an EZ Computation Report

This option is for the 2024 Annual Report if your business is filing above $1.23 Million in revenue but under $20 Million revenue received in the borders of Texas. If you choose this one and see an available 2024 report waiting to be filed then it’s good to proceed if you’re certain your business made between these amounts. If your business made under $1.23 Million revenue, skip to File a Public/Ownership Information Report. If your business made over $20 Million revenue, skip to the next option, File a Long Form Report.

If a blue text appears at the top of the screen saying “There are no period obligations…” this means that there is no filing available. In most cases this means it has already been filed and nothing is currently due. In some rare cases it can mean that the forfeiture is so old that the newer filings are not available through the online portal. Skip down to the View Transaction History point to see more information about this.

+ File a Long Form Report

This option is for any year where the business made over $20 Million in revenue. If you click on this and see one or more reports, these are ready to be filed as long as you’re certain your business made over $20 Million for any particular year.

+ File a Public/Ownership Information Report

This option serves two purposes.

1. In 2024, if your business made under $2.47 Million in revenue, only the Public Information Report needs to be filed with the Texas Comptroller. This will allow you to update any state information, such as your address and governing person(s) information. No tax would be due and this is understandably known as the “No Tax Due Report” option.

If a blue text appears at the top of the screen saying “There are no period obligations…” this means that there is no filing available. In most cases this means it has already been filed and nothing is currently due. In some rare cases it can mean that the forfeiture is so old that the newer filings are not available through the online portal. Skip down to the View Transaction History point to see more information about this.

2. For any other year, if you previously filed your Annual Report by mail but only included the Franchise Tax Report half of the report (remember, the Annual Report is the Franchise Tax Report and the Public Information Report combined), then the state is still expecting the second half. You can file this online through this button if it appears available.

+ File a No Tax Due Information Report (Only applicable for reports originally due prior to 1/1/24)

As seen in the parenthesis, this is for Annual Reports schedule to be due prior to 2024. If you’re reinstating you’re likely to find a 2023 report waiting to be filed here and if your business made revenue under the threshold, then this is necessary to be filed. You may find that it asks for reports further back than 2023 and if so, make sure to have those filed as well with the accurate revenues. You can file this report if the revenue your business brought in during the listed year is under the filing threshold. The threshold for filing these is:

For 2023, the threshold was $1.23 Million

For 2022, the threshold was $1.23 Million

For 2021, the threshold was $1.18 Million

For 2020, the threshold was $1.18 Million

If your business is reporting over these thresholds, see the information regarding File an + EZ Computation Report or + File a Long Form Report above.

If you go to file a report and you see an odd year where it cuts off, then you may owe more than 2 reports. For example, let’s say it’s 2024 and you know you haven’t ever filed a report, but when you access the File a No Tax Due Information Report option you see it lists 2021, 2022… but where’s 2023? Uh oh. The sad news is that you will not be able to file it all online. The Texas Comptroller of Public Accounts will need you to file by mail since the forfeiture is so old that they stopped making the filings available for you online. See the next section, File by Mail – 3 or more reports due, for instructions on how to go about this.

+ Request a First or Second Extension

This option will allow you to request an extension on needing to file a report. These won’t apply to reports that are already past the due date so if you’re here to reinstate, this button won’t do you any good. It’s potentially good to keep in mind for the future.

+ Make a Payment Only

Commonly when filing a report by mail the sender will neglect to include the payment, usually because it’s not always obvious one is due and if it is due, how much it should be. The Texas Comptroller doesn’t consider a report fully settled until the payment is made (usually $50 per report unless taxes are owed). This selection will allow you to go in and make a payment using a card of your choice.

+ View Transaction History

If you need to check for your records what has previously been filed online this button is your resource for it. Mailed-in filings and mailed-in payments won’t appear here, so if you’re wondering about those you’ll unfortunately need to give the Texas Comptroller a call at 512-463-4600 or 800-252-1381. Otherwise, any filings done online will populate here with a recording of the amount that you paid, what the filing was for and when exactly it was completed.

If you received a “No period obligations…” message when attempting to file, the filing you were trying to do should show up here. If it didn’t, it might have been filed by mail since that won’t get recorded on the online portal. Alternatively, your business might be too far behind on it’s taxes for anything to appear online, such as if it were to have been forfeited many years ago. Think 2018 and prior. Does this sound like you? Reach out to us and we can take a look into your specific situation for free!

+ Request Certificate for Termination (Certificate of Account Status)

You’re not here to terminate, you’re here to reinstate! Skip this one, but if you plan to formally close your business once the reinstatement has finalized, this is where you can come back to.

+ Request Clearance Letter for Reinstatement

This will be a useful button for the reinstatement process no matter what step you’re on. This can be treated as a starting point to figure out what exactly the state wants from you, as well as the final destination to obtain the Tax Clearance Letter which will allow you to finally reinstate after all this hard work.

Okay, what does that mean?

When you first access your business information in the Texas Comptroller portal you can come directly to this button and follow the few prompts to obtain your Certificate of Account Status for Reinstatement, also known as the Tax Clearance letter. At the end it will either show you a green bar and allow you to download the certificate or it’ll give you a list of reasons why it can’t provide it. This is a perfect way for you to find out exactly what reports or payments are needed in order to get caught up with the tax responsibilities.

As you go through this process you can come back to see if your Annual Reports and payments have been accepted yet, since those can take a couple of days to process once you’ve submitted them.

Once everything is filed and accepted, that glorious green bar will appear and allow you to download your Certificate. The hard part is now over. Pat yourself on the back!

As soon as you have it, proceed to Filing Your Reinstatement with the State in the guide below.

+ Change Franchise Tax Mailing Address

If you need to update your mailing address, this is where you can go to take care of that online.

File by Mail – 3 or More Reports Due

When the business surpasses two reports being due, the state will no longer populate those in the online portal to be filed. This means that if you want to get caught up on missed reports they’ll have to be filed by mail. Bummer.

Thankfully, the process isn’t too difficult and this guide is here to help you through it.

First, you’ll need to determine which reports are missing. If you prefer to sit on the phone and speak to a representative with the state to get a direct answer, the Texas Comptroller of Public Accounts can be reached at 512-463-4600 or 800-252-1381. If you prefer to handle things yourself, you’ll need to access the online portal with the steps below:

- Access the Webfile Portal here

- Either login to your account or create a new one to proceed

- Once you’re logged in you should see a blue button to the right hand side of the page that says “+ Assign Taxes/Fees“. Select it

- Enter in your 11-digit Taxpayer Number which can always be found for free here by searching your company name

- A white tab called Franchise Tax will drop down and allow you to put in the webfile number. Put in the full FQ or XT number. If this is green when you come to this page, this step has already been done. Go back to the first login page and jump to step 8

- Check the box and agree

- You will be routed back to the main page, though this time you should see your company as an available selection

- Click on your company in the box to open up your specific details

- About 10 or 11 bulleted options will show up on this new screen like the image below

By selecting File a No Tax Due Information Report you will be taken to the next screen which shows any available report filings.

If you come to this screen and it shows a report for last year as the only one to file, then you should be able to go further up in the guide and see the steps for File Online – 1 or 2 Reports Due. It’s likely that you only owe the last and current report to get back in good standing with the Texas Comptroller.

If you get a message saying “No Period Obligations…” this could mean that the reports have already been filed. Check the Request Clearance Letter for Reinstatement selection to see if it will allow you to download your Certificate of Account Status for Reinstatement. If it does, proceed onward in this guide to Filing Your Reinstatement with the State. If it doesn’t, you’ll need to call the Texas Comptroller at 512-463-4600 or 800-252-1381 to find out why or reach out to Kuma Filings so that we can take a personalized look into your situation for free.

If you come to this screen and it shows a couple reports, you’re on the right track. You’ll need to fill in the blanks on what’s missing. Let’s take a look at an example.

Let’s say today is within August of 2024. You go to this screen showing a list of reports and you see:

Annual Report – Report Year 2021

Annual Report – Report Year 2020

Annual Report – Report Year 2019

Since we’re in 2024, we can assume that 2022, 2023 and 2024 will all need to be filed as well, even though they aren’t available on the online account to file.

If this was your situation then you would be able to file the 2019, 2020 and 2021 report online, but you’ll need to download the forms for the missing years and mail those in instead. Those forms can be found here: https://comptroller.texas.gov/taxes/franchise/forms/

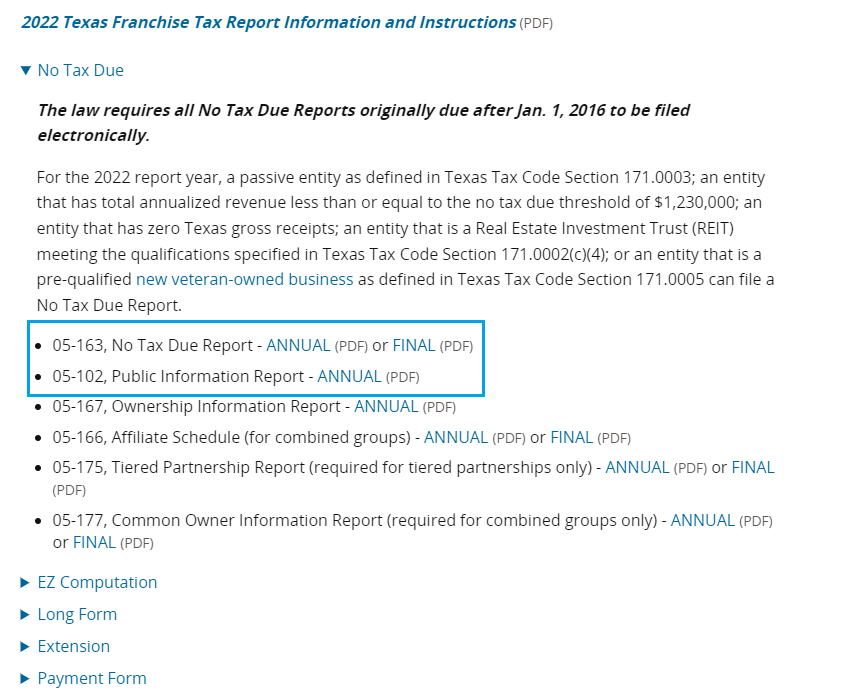

Remember, if you’re filing for a year from 2023 and prior you will need to fill out the Franchise Tax Report and the Public Information Report. Each year will need both of these forms filled out for the entire report to be considered complete. If you were needing to complete the 2022 report, for example, you would grab both of these forms outlined in blue.

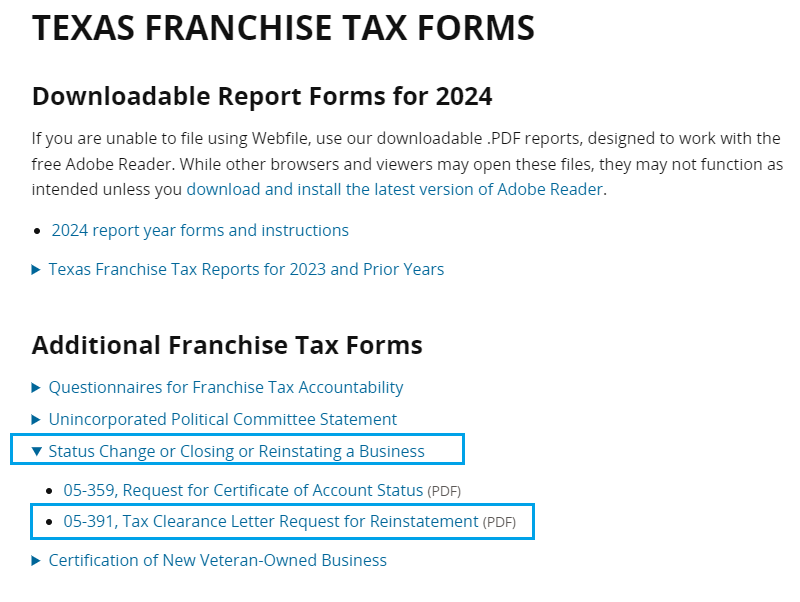

Once you have all your missing years filled out and read to go, be sure to also include a request for the certificate you’ll need to reinstate. On that same link to get the forms, you’ll see under Additional Franchise Tax Forms that there is a drop down option for Status Change or Closing or Reinstating a Business where there is the option to download a PDF for form 05-391, Tax Clearance Letter Request for Reinstatement (PDF).

So, if you have all your missing years filled out and you’ve completed the request for the tax clearance for reinstatement, your paperwork is ready to be mailed off. You can send this first class mail with a regular stamp or you can send it with tracking if you prefer to monitor it’s journey to the state. The choice is yours – just be sure you mail it to the Texas Comptroller at this address:

Texas Comptroller of Public Accounts

P.O. Box 149348

Austin, TX 78714-9348

Once the state processes all of this they’ll mail back instructions to download your tax clearance letter. Once you have it, proceed to Filing Your Reinstatement with the State in the guide below.

Filing Your Reinstatement with the State Online

You’ve made it to the last step for reinstatement. If it was a difficult process, know that it’s almost over!

If your business was forfeited due to not filing your annual reports then you can reinstate online. If your business was forfeited for another reason, such as not have a Registered Agent or because you purposefully dissolved it previously, the online method will not be available for you and you’ll need to look further down in the guide for your specific situation.

To reinstate you will need $75 and the Certificate of Account Status for Reinstatement, also known as the Tax Clearance Letter issued by the Texas Comptroller of Public Accounts. If you skipped down to this part of the guide but need help obtaining this, please see earlier above regarding obtaining this important document.

Ready to move on? Let’s do this.

- Head over to the Texas Secretary of State website.

- If you already have an account, log in using your credentials. If you don’t have one already you can either create an account or use a temporary account by selecting one of the options under the login button

- On the next page, choose the Credit Card option and enter in your card details in order to proceed since each search costs $1.

- Once you’re logged in the first thing you’ll need to do is click on the Business Organizations tab along the top bar

- A new page will give you lots of links to choose from. Find the box near the bottom called Change Documents where you can type in text.

- Either type in your 8 or 9 digit filing number and click File Document or, if you don’t know your filing number, type in nothing and click on Find Entity so that you can search for your company name and click the bullet point next to it. Once you find it, click Initiate Change Filing

- The page will show some details about your company such as the filing number, the company name, etc. The only option that should be available in the drop down menu is Reinstatement. Click Continue

- You will be guided through a few short questions in which you will need to upload your Certificate of Account Status for Reinstatement and input your name as the person reinstating/owning the business

- Submit! The total for the filing should be $75

- The Secretary of State typically takes around 2 business days to accept the reinstatement paperwork on a normal day, but holidays or the busy season (Jan – May) can cause delays. Delays normally do not exceed 5 business days.

Depending on what email you used for your login, the state will send the approved paperwork to you there. They will first send you a receipt showing that the filing was received and potentially the payment involved. They will then send you a confirmation of the filing itself with a copy of the paperwork. Once you receive this, you can rest assured that your business is back in action!

Resolving Involuntary Termination

Due to the unique nature of this, often your best option is to form a brand new business.

Usually the business is involuntarily terminated due to not paying the filing fee to form the business in the first place. This means that they state temporarily listed the business on the state record with the expectation of receiving that payment within a certain time frame. Once this time period passed, the state closed down the business after not receiving the complete fee. If this is the case, it may be best to form a new business from the beginning rather than try and revive a business that wasn’t truly ever active. If this sounds like your situation, Kuma Filings would be prepared to file this for you through the options here, depending on which type of business you plan to conduct.

Resolving Registered Agent Resignation

Ah, so your Registered Agent quit on you. This happens now and then and is a common reason why a business would need to reinstate. Usually there is a grace period to list a new agent, though plenty of people fail to realize they need to appoint a new one before their business is forfeited. Luckily, this isn’t too difficult to remedy.

You will need the filing fee payment, the Certificate of Account Status for Reinstatement issued by the Texas Comptroller of Public Accounts, and Form 811 from the Texas Secretary of State. These will all need to be sent in to the state. Let’s go through these one by one to make sure you can take care of each item.

The Filing Fee:

This is $75 for any business trying to reinstate for not having a Registered Agent, with the exception of Non-Profit Organizations which are charged $5. The Secretary of State accepts: (1) a personal check or money order; (2) a funded LegalEase account; or (3) a prefunded secretary of state client account. Regardless of which method you choose, the Secretary of State requires that you include Form 807, the payment form. This can be found here.

The Certificate of Account Status:

A Non-Profit Organization does not require a certificate, but for everyone else if you still need this, please follow the steps earlier in the guide above under Resolving Tax Forfeiture in order to obtain your Tax Clearance Letter.

Form 811:

Found here. This form is used to outline your business information and ensure your business is successfully reinstated. Inside this form is a space to list a new Registered Agent. Be sure to fill this out so that the state can list the new agent information and get your business back into a compliant state.

Some important things to remember about a Registered Agent is that the agent must be within the borders of Texas and cannot be the company itself. You, the owner, can be the Registered Agent for your business or you can choose to hire a third party company to handle the task for you. You can sign up with Kuma Filings for Registered Agent service and we’ll set you up with a reliable agent service.

Once you have the filing fee, the payment form, the certificate and form 811 all together, send those off to the Texas Secretary of State through one of these methods:

Mail:

Texas Secretary of State

P.O. Box 13697

Austin, Texas 78711-3697;

Fax:

(512) 463-5709

In Person:

James Earl Rudder Office Building

1019 Brazos

Austin, Texas 78701

Once accepted, the state will return the stamped paperwork to you showing the filing has been completely processed and filed. This means your business is back in action! Congratulations!

Resolving Voluntary Dissolution / Withdraw

Well, you did everything right and closed your business down formally, but now you want to start operating again for one reason or another. No problem!

With the exception of Non-Profit Organizations, a business will need to obtain a Certificate of Account Status in order to reinstate the business in Texas. All businesses will need to provide the filing fee payment and fill out Form 811. Let’s go through these one by one to make sure you can take care of each item.

The Filing Fee:

This is $15 for any business trying to reinstate after formally terminating, with the exception of Non-Profit Organizations which are charged $5. The Secretary of State accepts: (1) a personal check or money order; (2) a funded LegalEase account; or (3) a prefunded secretary of state client account. Regardless of which method you choose, the Secretary of State requires that you include Form 807, the payment form. This can be found here.

The Certificate of Account Status:

A Non-Profit Organization does not require a certificate, but for everyone else if you still need this, please follow the steps earlier in the guide above under Resolving Tax Forfeiture in order to obtain your Tax Clearance Letter. In the case of a voluntarily terminated business, you may be able to download the certificate without filing any reports.

Form 811:

Found here. This form is used to outline your business information and ensure your business is successfully reinstated.

Once you have the filing fee, the payment form, the certificate and form 811 all together, send those off to the Texas Secretary of State through one of these methods:

Mail:

Texas Secretary of State

P.O. Box 13697

Austin, Texas 78711-3697;

Fax:

(512) 463-5709

In Person:

James Earl Rudder Office Building

1019 Brazos

Austin, Texas 78701

Once accepted, the state will return the stamped paperwork to you showing the filing has been completely processed and filed. This means your business is back in action! Congratulations!

What to do if your business name has been taken while your business wasn’t active on the state record

It’s possible that while your business was in poor status with the state, someone else swooped in and took your perfect business name. Unfortunately, since your business was forfeited or dissolved the name you had was made available for others to snatch up. If this happened to you, there’s not much you can do about it.

You could write a letter to the new business owner’s Registered Agent via Certified Mail requesting that they change their name, but generally there usually isn’t any legal ground to stand on. If they’re super nice, maybe they’ll work something out with you, though the odds likely aren’t in your favor. It belongs to them until such moment as they terminate or forfeit.

It’s most likely that you’ll need to select a new business name. Head on over to the Texas Secretary of State to see the rules for what names are acceptable. Something too close to a name already in use on the state record will be rejected, which means more lost time in the process of reinstating if they reject it and force you to resubmit your paperwork with a new name. Here are some easy things to keep in mind:

Additional words or punctuation:

For example, the name currently on the state record – Companyname LLC

These would be rejected – Company Name LLC, Company Name, L. L. C., The Company Name LLC, Company names LLC

These would be acceptable – A Super Cool Companyname LLC, Companyname 35 LLC, My Brand New Company Name LLC

Abbreviations:

The name on the state record – A&A LLC

These would be rejected – A and A LLC, A + A Company Inc., The A&A, LLC

These would be acceptable – AA LLC, AAA LLC, AAB LLC

Restricted Words

Bank, Olympic, Trust, College, University, Law School, Veteran, War, and other similar words. These are permissible if accompanied by the appropriate approval from the Banking Commissioner, the Texas Higher Education Coordinating Board or a veterans organization pursuant to §5.062 of the Texas Business Organizations Code depending on which you are trying to use.

There are other rules that the state follows outside of the common issues above and the three main points above are meant to be a minimum guidance to follow.

Reinstating a Non-Profit Organization

If you have a Non-Profit Organization or Corporation, you’re in luck! You get to skip the tasking step of obtaining the Certificate of Account Status, better known as the tax clearance letter.

There are two important steps to address when reinstating a nonprofit.

- Know your tax responsibility. If your business is registered with the Texas Comptroller of Public Accounts as tax exempt then you shouldn’t owe any state taxes on an annual basis. Instead you would likely owe a Periodic Report to the Secretary of State every 4 years. You can check the Tax Exempt Entity Search to make sure your business has the proper exemption status.

If your business is not exempt you will still need to file your missing reports. To do so, research higher in the guide and follow the same steps an LLC would in order to file your reports. It’s important to complete these, then address any desire to be tax exempt once you’re all caught up. For more information about becoming tax exempt, the Texas Comptroller of Public Accounts can be contacted at 512-463-4600 or 800-252-1381. - File your reinstatement with the Secretary of State. The Texas Secretary of State will not require a tax clearance letter in order to get your business back in good standing, making the process simple and easy. The filing fee will be an affordable $5.

- Head over to the Texas Secretary of State website.

- If you already have an account, log in using your credentials. If you don’t have one already you can either create an account or use a temporary account by selecting one of the options under the login button. Either way you’ll need to give your card details since each search costs $1.

- Once you’re logged in the first thing you’ll need to do is click on the Business Organizations tab along the top bar

- A new page will give you lots of links to choose from. Find the box near the bottom called Change Documents where you can type in text.

- Either type in your 8 or 9 digit filing number and click File Document or, if you don’t know your filing number, type in nothing and click on Find Entity so that you can search for your company name and click the bullet point next to it. Once you find it, click Initiate Change Filing

- The page will show some details about your company such as the filing number, the company name, etc. The only option that should be available in the drop down menu is Reinstatement. Click Continue

- You will be guided through a few short questions involved in the filing

- Submit! The total for the filing should be $5

- The Secretary of State typically takes around 2 business days to accept the reinstatement paperwork on a normal day, but holidays or the busy season (Jan – May) can cause delays. Delays normally do not exceed 5 business days.

Depending on what email you used for your login, the state will send the approved paperwork to you there. They will first send you a receipt showing that the filing was received and potentially the payment involved. They will then send you a confirmation of the filing itself with a copy of the paperwork. Once you receive this, you can rest assured that your business is back in action!

Reinstating a Professional Association

If you find yourself in the situation where you must reinstate a Professional Association and it cannot be done online, then instead of Form 811, you will need to file Form 814. You will also need to include Form 803 for each year it is missing.

The filing fee for the reinstatement (Form 814) is ($75) and for each delinquent annual statement (Form 803) that must be submitted with the reinstatement is ($35). If your business name was taken while your PA was forfeited, then you will need to include an Amendment (Form 424 or 406) to select a new name along with the filing fee of $150.

Accepted methods of payment are: (1) a check or money order payable to the Secretary of State; (2) a valid American Express, Discover, MasterCard, or Visa credit card; (3) a funded LegalEase account; or (4) a prefunded Secretary of State client account. Credit card transactions are subject to a statutorily authorized convenience fee of 2.7% of the total fees incurred, if applicable. Use Form 815 to pay by credit card, LegalEase, or client account.

Once all of the above is taken care of, this can be sent to the Secretary of State by one of these methods:

Mail:

Secretary of State

Reports Unit

P.O. Box 12028

Austin, Texas 78711-2028

In Person:

James Earl Rudder Office Building, Reports Unit

1019 Brazos

Austin, Texas 78701

Fax:

(512) 463-1423

Once accepted, the state will return the stamped paperwork to you showing the filing has been completely processed and filed. This means your business is back in action! Congratulations!

Hire Kuma Filings!

Kuma Filings is prepared to assist with any reinstatement situation that your business might be facing.

If you would like to have someone take a look into your situation for you and assess the reason for forfeiture, the steps you need to take or to give you an estimate of cost to hire Kuma Filings, reach out at any time and someone will be in touch within 24 hours.

Disclaimer: This guide is provided for informational purposes only and does not constitute legal advice. While we strive to offer helpful tools and resources, Kuma Filings recommends consulting with a qualified legal professional for guidance when necessary.